-

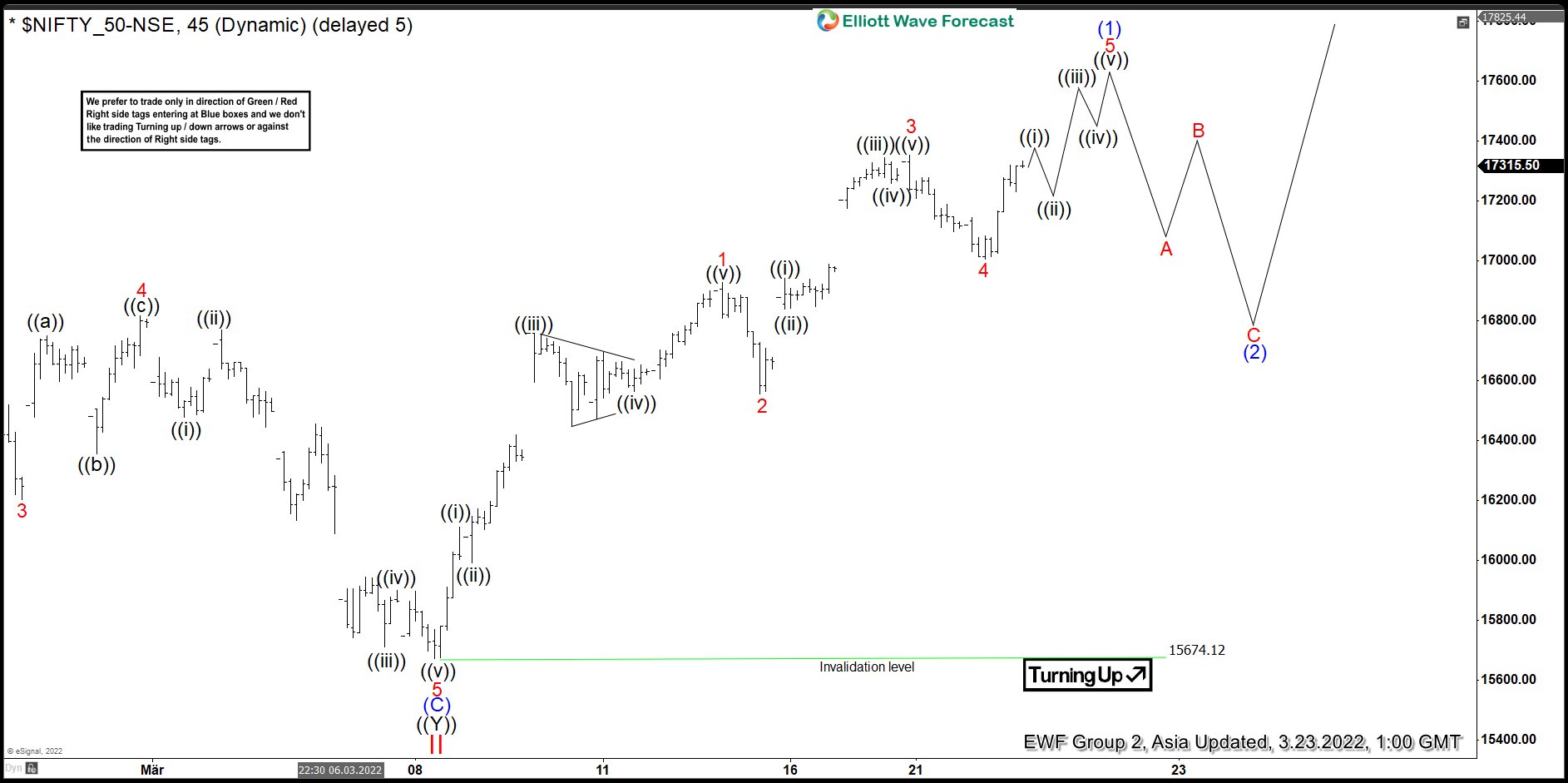

Elliott Wave View: Nifty Reacting Higher After 3 Swing Pullback

Read MoreNifty ended correction to the cycle from March 2020 low and starts a new leg higher. This article and video look at the Elliott Wave path.

-

Elliott Wave View: AUDJPY Starts a New Bullish Cycle

Read MoreAUDJPY may have started a new bullish cycle as it breaks above previous daily high on November 21, 2021. This article & video look at the Elliott Wave path.

-

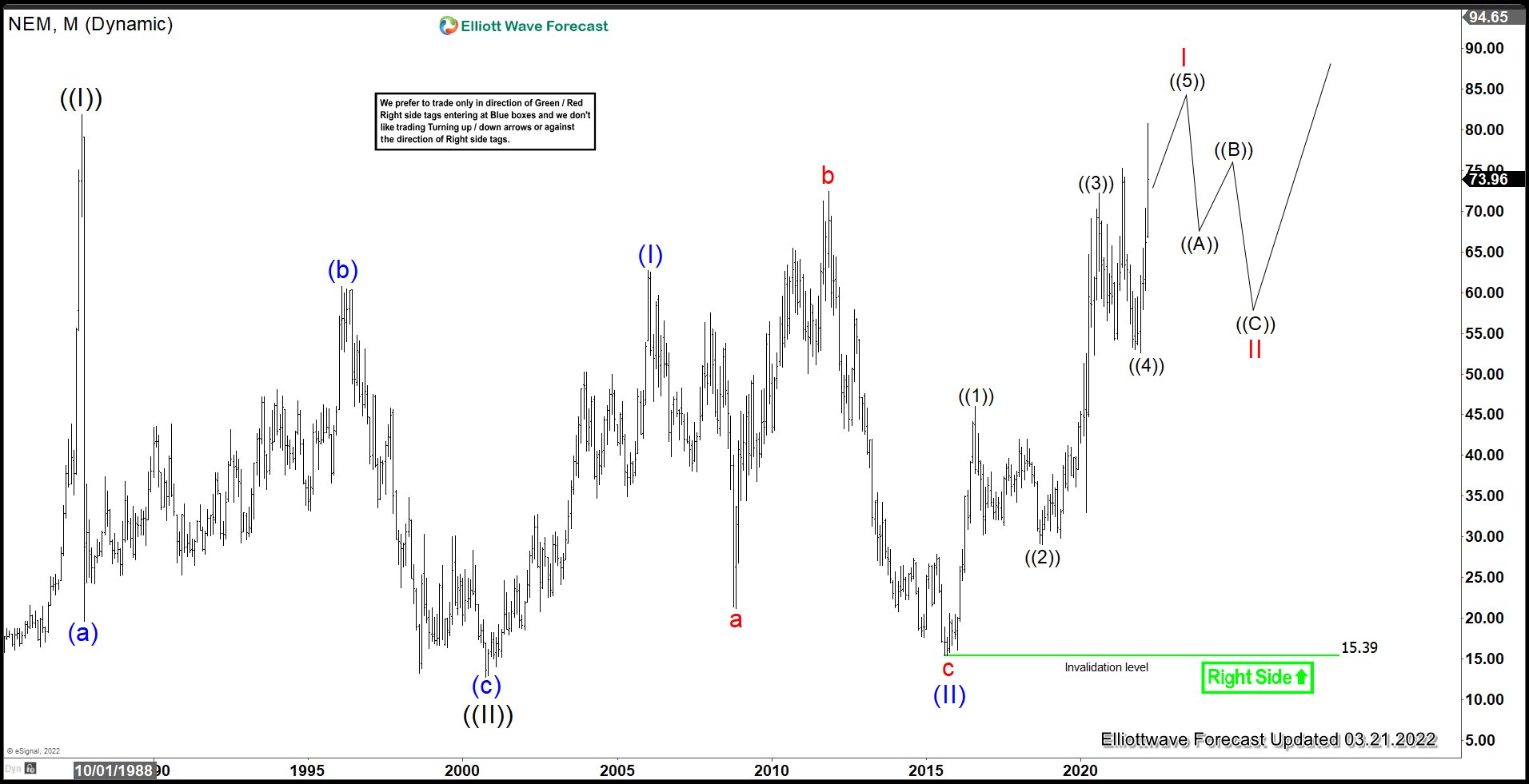

Newmont Mining (NEM) Leading Miners to the Upside

Read MoreNewmont Mining (ticker: NEM) is the world’s largest gold mining company, based in Greenwood Village, Colorado, United States. It has ownership of gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname. Newmont is the only gold producer listed in the S&P 500 Index. The company is leading […]

-

Elliott Wave View: Silver Buyers Should Appear Soon

Read MoreSilver (XAGUSD) is correcting cycle from February 3, 2022 low but buyers should appear soon. This article and video look at the Elliott wave path.

-

Pan American Silver (PAAS) Has Started the Next Bullish Leg

Read MorePan American Silver Corporation (ticker: PAAS) is engaged in the production and sale of silver, gold, zinc, lead and copper. It also has other related activities, including exploration, extraction, processing, refining and reclamation. The company operates 10 mining sites, including La Colorada, Dolores, Huaron, Morococha, San Vicente, Manantial Espejo, Shahuindo, La Arena, Timmins and Escobal. In […]

-

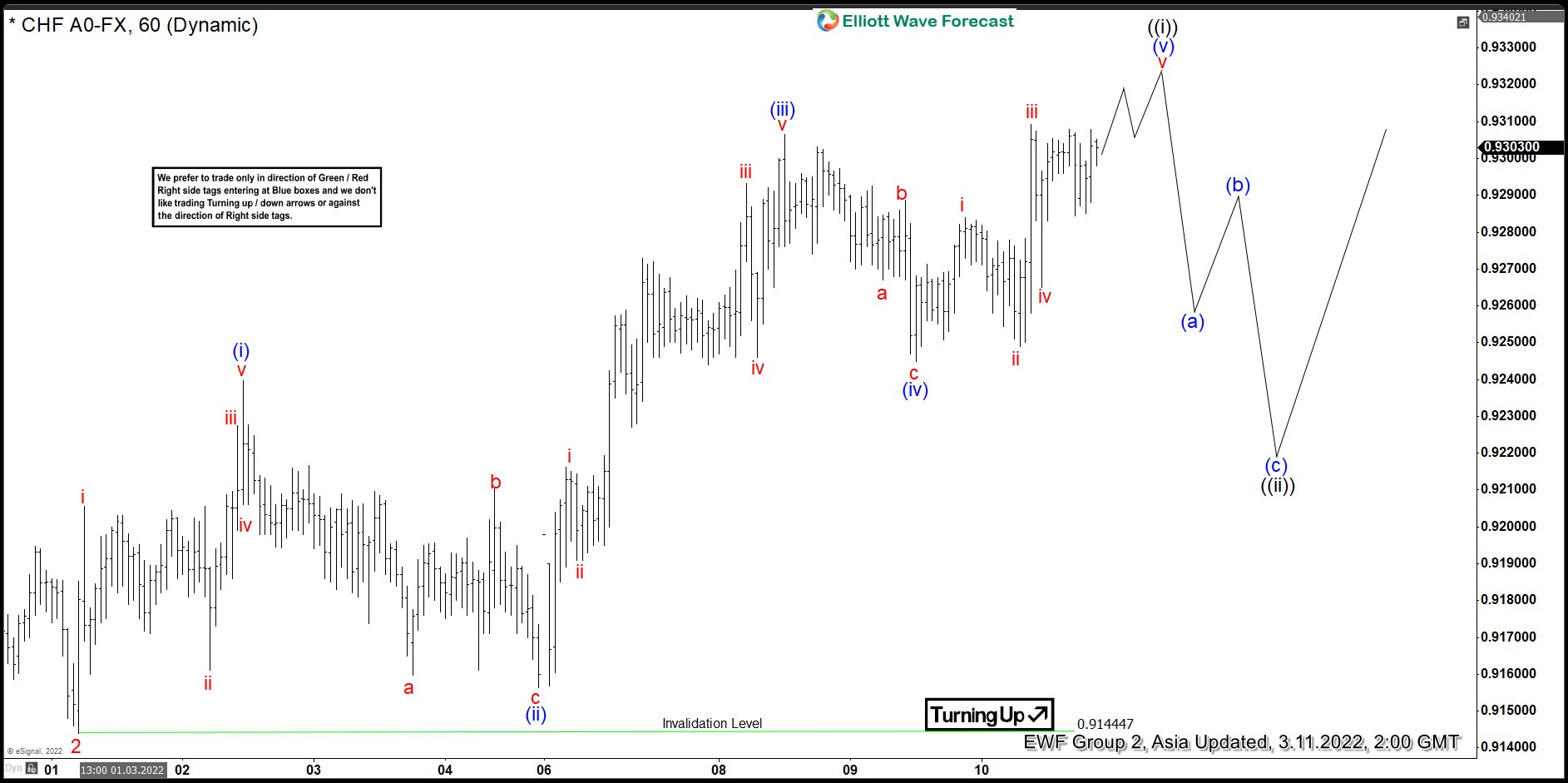

Elliott Wave View: USDCHF 5 Waves Rally Favors Upside

Read MoreUSDCHF rallies from January 13, 2022 low as an impulse. This article and video look at the Elliott Wave path of the pair.