Shopify (SHOP) enters the next quarters with solid momentum, and more importantly, its latest results suggest that this strength is not temporary. The company delivered 31% year‑over‑year revenue growth. Also, it saw GMV accelerate across North America, Europe, and Asia, with Europe alone growing 42% on a constant‑currency basis. As a result, management now expects revenue to expand at a mid‑to‑high‑twenties pace next quarter, while gross profit should rise at a low‑twenties rate. Taken together, these indicators point to a business benefiting from both resilient merchant activity and the compounding effects of its long‑term product investments.

Looking ahead, Shopify’s financial posture appears increasingly disciplined. The company plans to keep operating expenses at 38%–39% of revenue, and at the same time, it anticipates maintaining free cash flow margins in the mid‑to‑high teens. Consequently, investors can expect the stock to trade with a constructive bias as the company balances growth with expanding profitability. If these trends continue, Shopify could enter the next quarters with a clearer path toward sustained margin expansion, stronger liquidity, and a valuation supported by consistent execution rather than speculative enthusiasm.

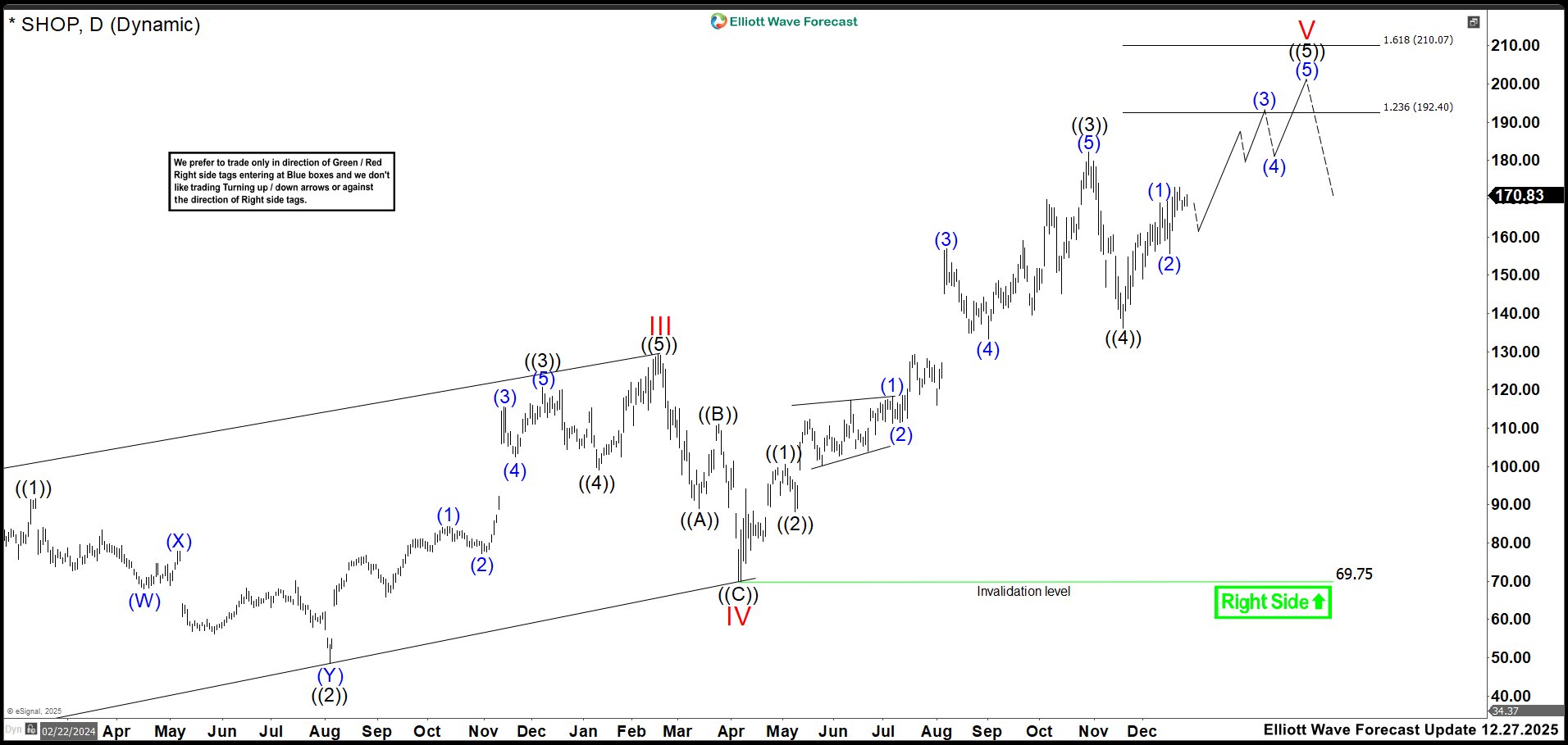

Elliott Wave Outlook: SHOP Daily Chart August 2025

Last update, SHOP had extended its rally. It formed a clean impulsive structure. The earnings gap hit resistance near 154.61, and we labeled that level as wave (3) of ((3)). From there, we expected more upside. Waves 4s and 5s were set to unfold, pushing price into wave ((5)) of V. As a result, that advance was likely to complete wave V of (I). After that, we anticipated a new correction. Wave V of (I) was projected to finish above 166.30. Therefore, we avoided selling. We focused only on buying opportunities. (If you want to learn more about Elliott Wave Principle, please follow these links: and .)

Elliott Wave Outlook: SHOP Daily Chart December 2025

Today’s update shows that after completing wave (4), price resumed its advance in wave (5) of ((3)), reaching a high of 182.19 in October. Then, it faced a sharp correction, dropping 25% to the 136.18 low. This decline may have misled many traders into thinking a higher‑degree pullback had begun. However, that is not the case, because the bullish trend can still extend.

At this stage, we expect the market to build an impulse as wave ((5)) of V to complete the cycle that started in November. This move could reach the 192.40–210.07 zone, where we anticipate strong selling pressure, at least enough to trigger a corrective reaction. Even so, market conditions remain bullish, and we cannot rule out further upside. Therefore, the strategy stays the same: buy the dips until price reaches the next zone and then evaluate the reaction there.

Transform Your Trading with Elliott Wave Forecast!

Ready to take control of your trading journey? At Elliott Wave Forecast, we provide the tools you need to stay ahead in the market:

✅ Blue Boxes: Stay ahead in the market with fresh 1-hour charts updated four times daily, daily 4-hour charts on 78 instruments. Precise Blue Box zones that highlight high-probability trade setups based on sequences and cycles.

✅ Live Sessions: Join our daily live discussions and stay on the right side of the market.

✅ Real-Time Guidance: Get your questions answered in our interactive chat room with expert moderators.

🔥 Special Offer: Start your journey with a 14-day trial for only $0.99. Gain access to exclusive forecasts and Blue Box trade setups. No risks, cancel anytime by reaching out to us at support@elliottwave-forecast.com.

💡 Don’t wait and get a DISCOUNT for any plan!

Click in the next link, go to Home Chat and ask for a flat discount code saying that you saw this in Luis’ Blog: 🌐