Hello Traders! In today’s update, we’ll revisit the Elliott Wave structure of Bitfarms Ltd. ($BITF) and provide insights into the next phase of its price action. You can check the last article here. As anticipated, a Zig-Zag (ABC) pattern is unfolding, approaching a critical support zone where buyers have historically stepped in. Let’s break down the key developments.

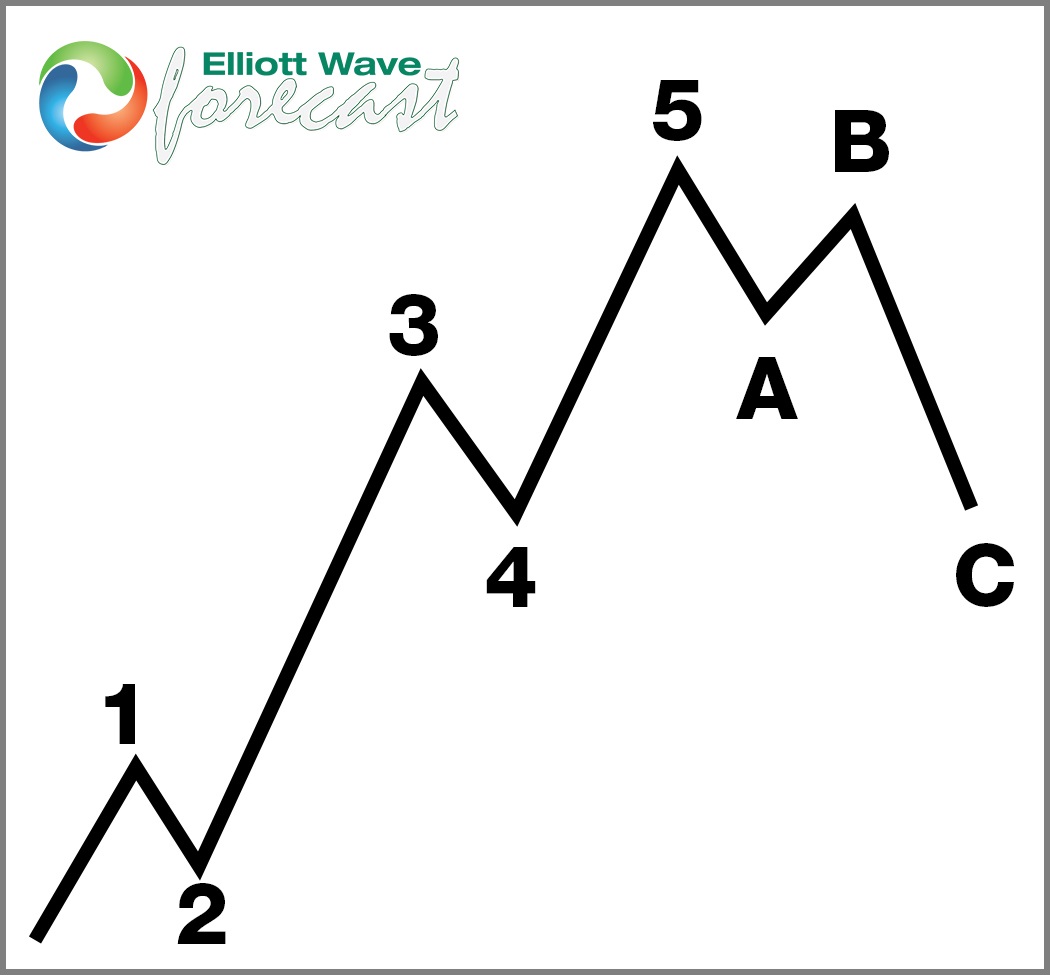

5 Wave Impulse Structure + ABC correction

$BITF Daily Elliott Wave View October 28th 2025:

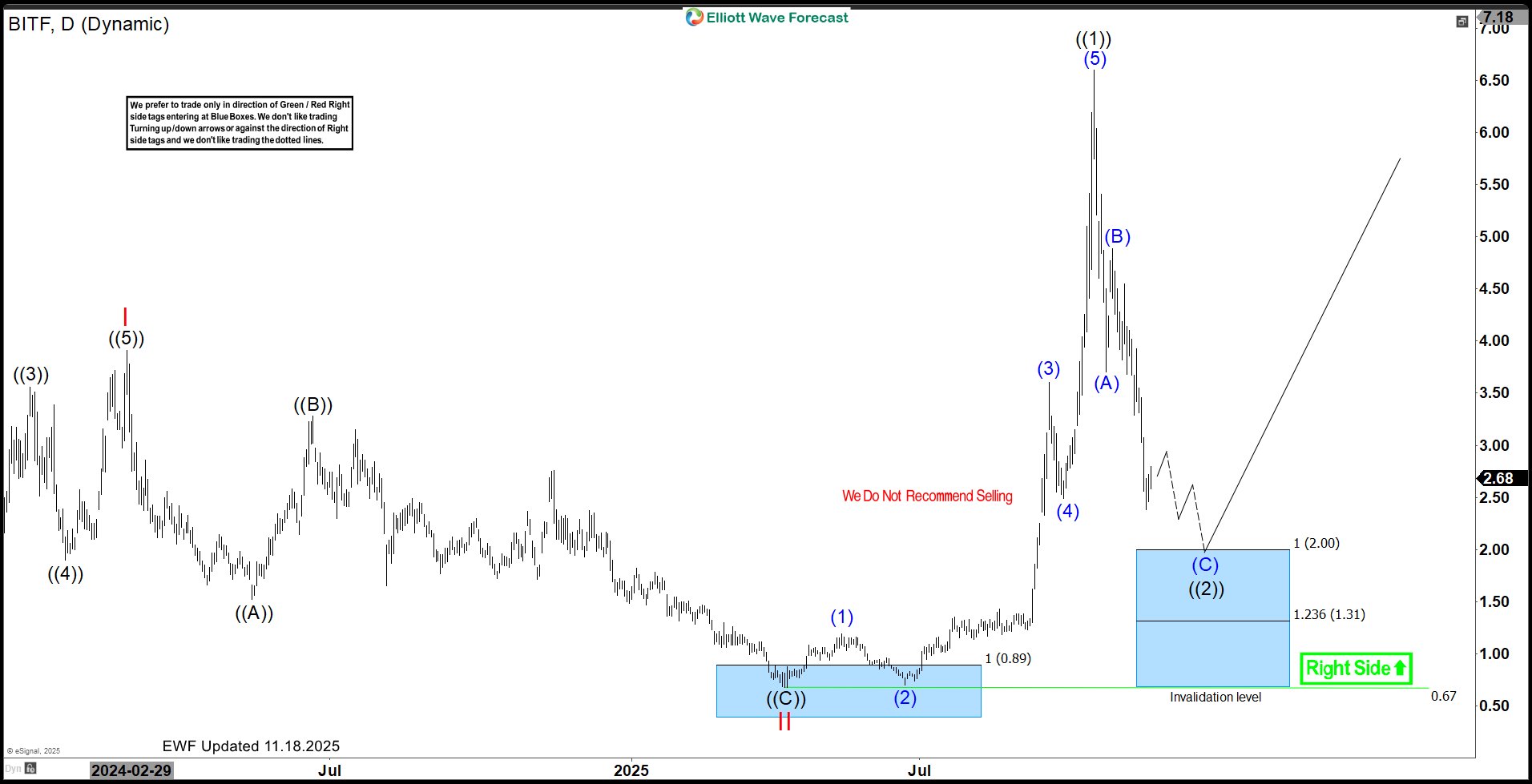

$BITF Daily Elliott Wave View November 18th 2025:

Since our last update, $BITF has continued to decline,. The stock is now approaching the blue box area, where buyers may step in. Here’s how the structure is unfolding so far:

Since our last update, $BITF has continued to decline,. The stock is now approaching the blue box area, where buyers may step in. Here’s how the structure is unfolding so far:

- The first leg lower, labeled wave (A), has already formed, marking the initial phase of the pullback.

- This was followed by a bounce in wave (B), which failed and broke below wave (A).

- The stock is now trading in wave (C) of the larger wave ((2)) correction, which should target the area at $2.00–$0.67.

Blue Box Area: A Key Buying Opportunity

The Blue Box area represents a high-probability reversal zone where buyers could re-enter for the next bullish cycle. This correction, which follows the 5-wave impulse, allows the market to reset and create new opportunities for traders.

- Wave Structure: Corrections typically unfold in 3 swings (ABC), with wave (C) often extending into the Blue Box.

As $BITF approaches this zone, traders should closely monitor price action for signs of reversal and a resumption of the larger uptrend.

What’s Next for $BITF?

Once wave ((2)) completes in the Blue Box area, we expect $BITF to resume its bullish trend with a rally in wave ((3)). This next impulsive move could take the stock to new highs, continuing its uptrend.

Conclusion

The current correction in Bitfarms Ltd. ($BITF) aligns with our Elliott Wave analysis and offers a strategic buying opportunity. As the stock approaches the $2.00–$0.67 area, traders should prepare to capitalize on the next leg of the uptrend. Stay patient, focus on risk management, and let the Elliott Wave structure guide your decisions.

Elliott Wave Forecast

We cover 78 instruments, but not every chart is a trading recommendation. We present Official Trading Recommendations in the Live Trading Room. If not a member yet, Sign Up for 14 days Trial now and get access to new trading opportunities.

Welcome to Elliott Wave Forecast!