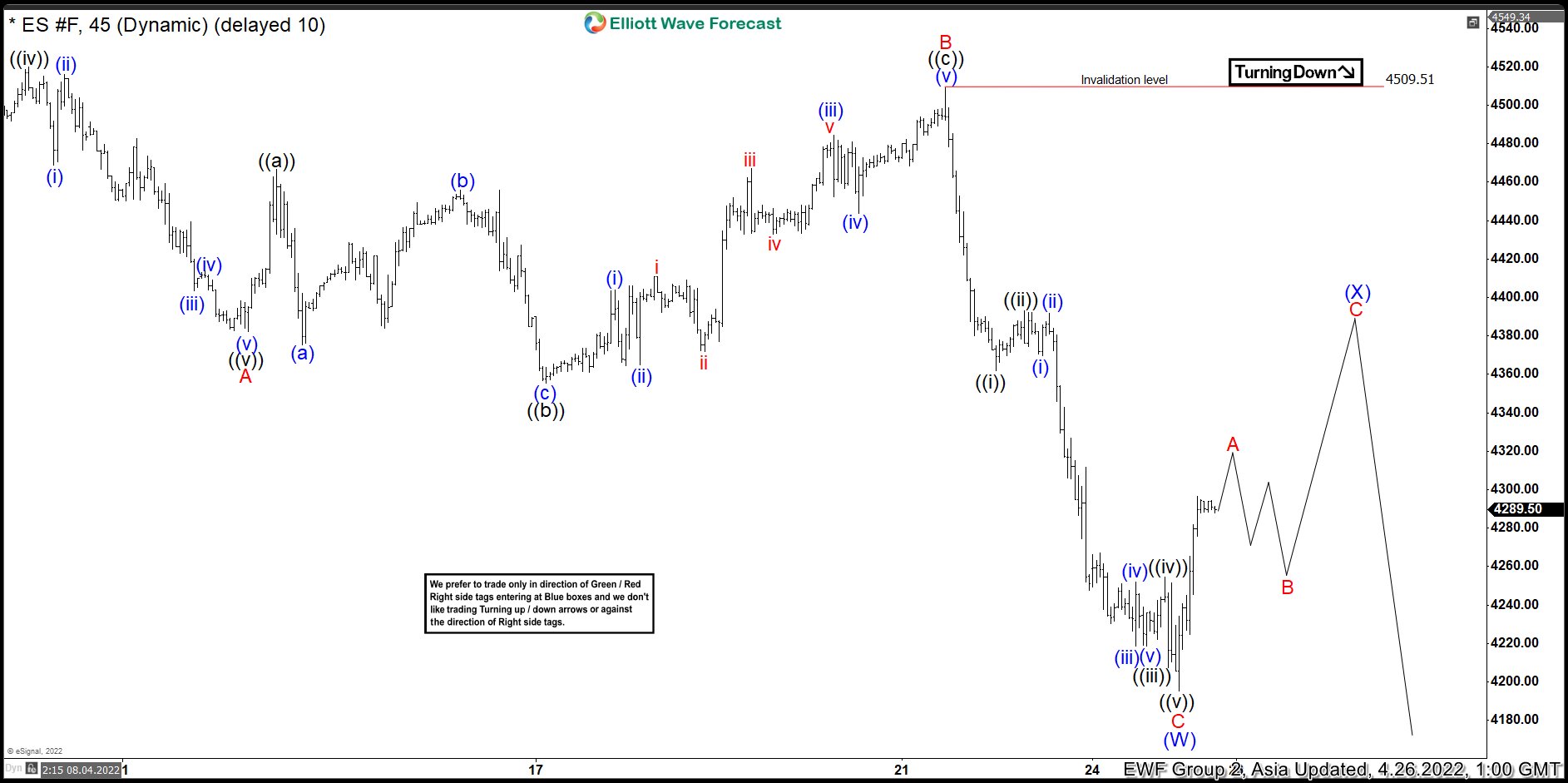

Short term Elliott Wave view in S&P 500 E-mini Futures (ES) suggests cycle from March 30, 2022 has ended in wave (W) at 4195.25. The internal subdivision of wave (W) unfolded as a zigzag Elliott Wave structure. Down from March 30 peak, wave A ended at 4382.25 and rally in wave B ended at 4509.51. Index then extended lower in wave C towards 4195.25 which completed wave (W). Wave (X) corrective rally is currently in progress to correct cycle from March 30 peak in a larger degree 3 , 7, or 11 swing before Index resumes the decline lower.

The internal subdivision of wave (X) is proposed to be in the form of a zigzag Elliott Wave structure. Near term, expect wave A to end soon, then Index should pullback in wave B before turning higher again in wave C. Near term, as far as pivot at 4509.51 high, and more importantly March 30, 2022 pivot high at 4631 stays intact, expect rally to fail in 3, 7, or 11 swing for further downside. Potential target lower is 100% – 161.8% Fibonacci extension from January 4, 2022 peak which comes at 3490 -3927.