Biotechnology is the study of living creatures, biological systems, or derivatives to develop and/or improve healthcare products and therapies. This technology is connected with medical and pharmaceuticals, genomics, and food and chemical manufacturing.

Biotechnology is the study of living creatures, biological systems, or derivatives to develop and/or improve healthcare products and therapies. This technology is connected with medical and pharmaceuticals, genomics, and food and chemical manufacturing.

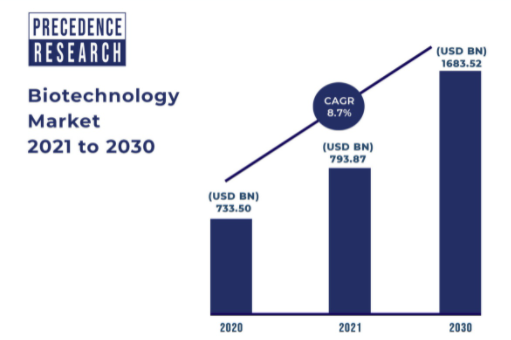

According to Precedence Research, the biotechnology market size is expected to surpass around US$ 1,683.52 billion by 2030 and expand growth at a CAGR of 8.7% from 2021 to 2030.

What are the Growth Drivers of Biotechnology?

The growing instances of chronic diseases are one of the major drivers of the growth of the biotech sector. The bio-pharmacy segment is contributing towards the prevention of chronic diseases and is focusing on personalized treatment plans. In addition to it, the new cell therapy concepts are also being introduced which has further driven the industry growth.

What are the Challenges Faced by the Biotech Companies?

User-friendly tools are essential for bioinformatics platform utilization. And many bioinformatics applications require significant computer knowledge. Therefore, equipment and implementation costs are very high in the industry.

In addition to high equipment costs, this industry has large-scale data of patients. Since medical data is confidential, the management of this huge scale data is very important and currently a challenge for the industry. Also, with such large-scale data, analysis is required to better understand and develop relevant technologies in the future. Therefore, the data of the biotech sector is extremely valuable.

The Opportunities for the Biotech Sector

The development of innovative techniques to treat diseases is very crucial for the biotechnology market. More and more r412esearch and the ongoing technological advancements are excellent opportunities for growth for this sector. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

The pandemic has created an abundance of opportunities for the biotech sector. Especially those who are engaged in the treatment and development of the COVID-19 vaccine. Hence a wise investment decision would be to seek COVID-19 vaccine companies with successful drugs in the market and/or pipeline. Many leading biotech companies are winning the biotech market with highly demanding drugs already in the market and strong drugs in pipelines.

List of Best Biotech Stocks to Buy in 2024

Here we have compiled some of the best biotech stocks to buy in 2024:

| Sr. # | Name | Symbol | Market Capitalization | Price (As of 9th March 2021) |

| 1 | Johnson and Johnson | JNJ | $445.8 billion | $169.36 |

| 2 | Pfizer | PFE | $275.9 billion | $48.75 |

| 3 | Bristol Myers Squibb | BMY | $149.57 billion | $68.13 |

| 4 | Amgen | AMGN | $127.4 billion | $231.46 |

| 5 | Genmab | GMAB | $21.42 billion | $32.93 |

| 6 | Regeneron Pharmaceuticals | REGN | $68.3 billion | $623.43 |

| 7 | Vertex Pharmaceuticals | VRTX | $61.35 billion | $239.24 |

| 8 | Novavax, Inc | NVAX | $5.9 billion | $79.07 |

| 9 | Relay Therapeutics | RLAY | $2.75 billion | $24.51 |

| 10 | Axsome Therapeutics | AXSM | $1.2 billion | $31.13 |

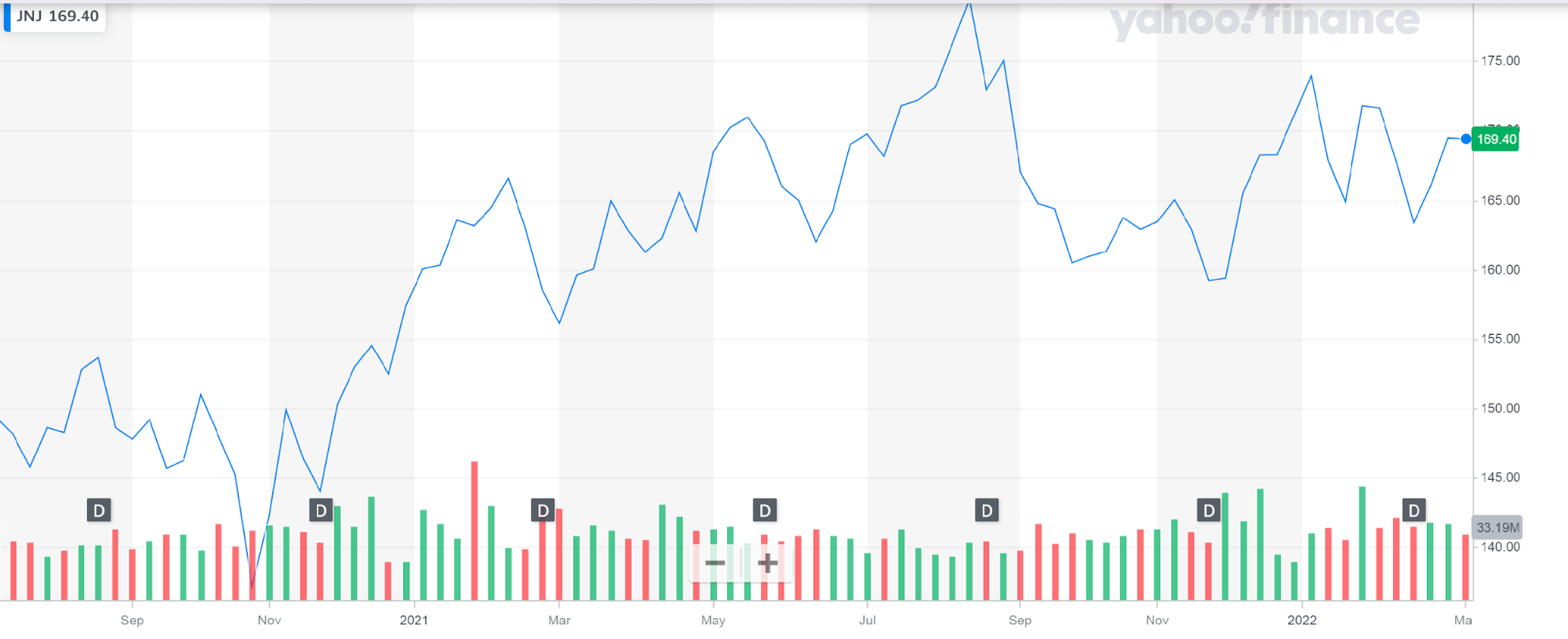

Johnson and Johnson

Johnson & Johnson is one of the oldest pharmaceutical companies. It engages in the research and development, manufacture, and sale of products in the health care field. It operates through three segments: Consumer Health, Pharmaceutical, and Medical Devices. Johnson & Johnson maintains operations in 60 countries, while its roughly 250 subsidiaries and their products are sold in more than 175 countries.

Johnson and Johnson recently announced its fourth-quarter and full-year results of 2021.

- Total sales of $93.8 billion were reported, representing a 13.6% growth.

- Net income was reported to be $20.9 billion, representing a 42% increase

- Earnings per share were reported at $7.81

Johnson and Johnson is a $445 billion company. Its share is trading at a price of $169.36. the company’s stock is on a bullish run since the development and approval of its COVID-19 vaccine. During the year 2021, the stock peaked at $179.

By using the stock signals, you can avoid hours of technical analysis to understand the market.

By using the stock signals, you can avoid hours of technical analysis to understand the market.

Check out the best NFT stocks to buy now.

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers medicines and vaccines in various therapeutic areas. The company became a household name when it developed the first mRNA-based COVID-19 vaccine. Semi conductor stocks are one of the best investment opportunities.

The company recently announced its full-year results of 2021

- Revenue of $81.3 billion was reported, a 95% growth.

- Net Income was reported to be $22 billion, representing more than 100% growth in a year.

- Earnings per share were reported to be $3.85.

- During the year a total of $8.7 billion in cash dividends were paid to investors

Pfizer has a lot of new drugs in the pipeline and under clinical development. With the demand for COVID-19 vaccines still high, the future outlook of the company is positive and focused on growth. The company management has provided full-year record-high revenue guidance for 2022 at $98 billion to $102 billion.

Get to know everything about high frequency trading.

Pfizer’s market valuation is around $274 billion. Its share is currently trading at around $48.88. The company’s stock has been on an upward streak since the first COVID-19 vaccine was developed. By the end of 2021, the stock of the company peaked at $59.

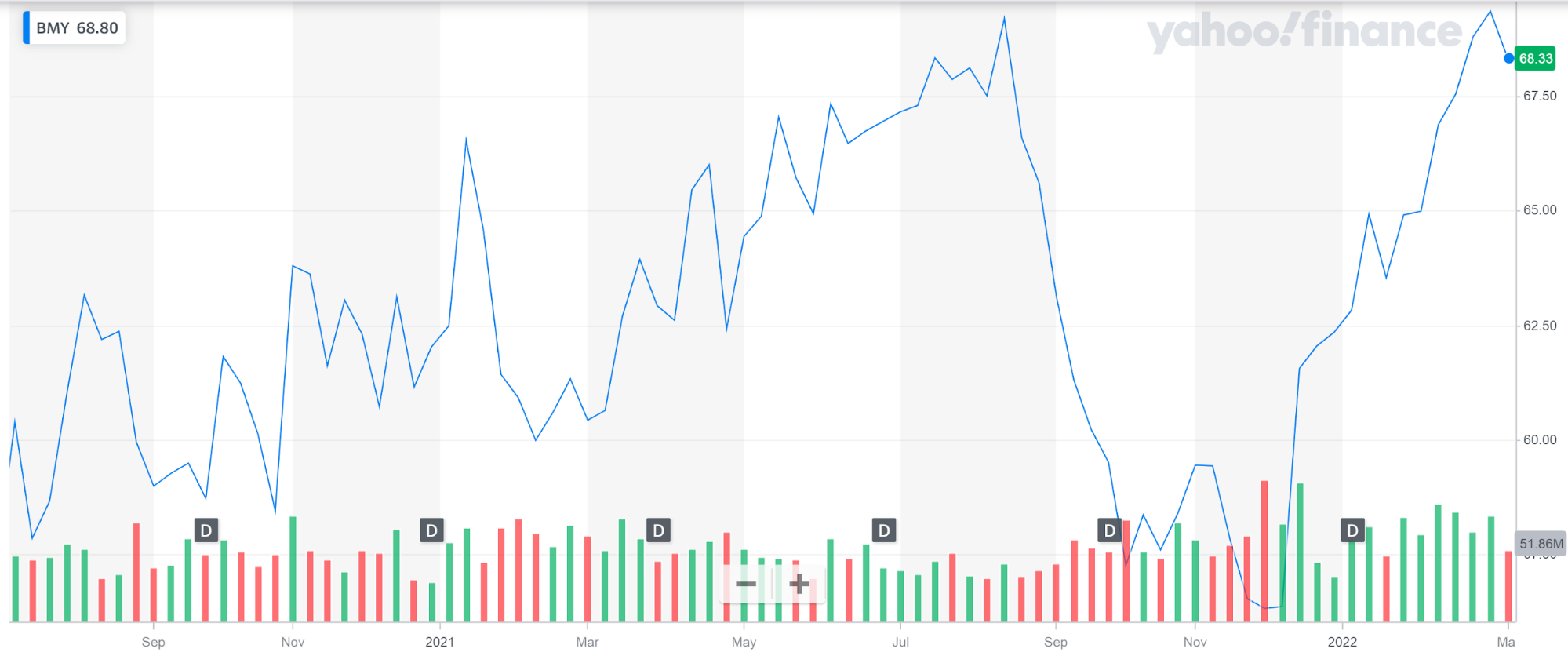

Bristol Myers Squibb

Bristol Myers Squibb

BMS is one of the world’s largest pharmaceutical companies and is consistently ranked on the Fortune 500 list of the largest U.S. corporations. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, neuroscience, and covid-19 diseases.

Bristol Myers Squibb has recently shared its fourth-quarter results for the year 2021:

- Total revenues were reported to be $12 billion.

- A total of $2.6 billion were invested in R&D.

- Earnings per share were reported to be $1.07

The company has been consistently paying dividends. In fact, the company has a record of 13th consecutive annual dividend increase.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Bristol Myers Squib has a market valuation of $149 billion. Its share is trading at a price of $68.34. The stock of the company has been on an interesting journey in the past two years. Post pandemic, despite exhibiting volatility, the share of the company continued to rise. After hitting the peak of $69 in August 2021, the stock plunged to around $56. The stock picked up again in December 2021 and has been rising to date.

Amgen

Amgen

Amgen is one of the world’s leading biotechnology companies. The Company discovers, develops, manufactures, and delivers various human therapeutics. It operates in the human therapeutics segment. Tech Stocks is one of the best investment option.

Amgen announced financial results for the fourth quarter and full-year 2021:

- Total revenue was reported at $26 billion

- Net income was reported at $5.9 billion

- Earnings per share were reported to be $10.28

- A dividend of $7.04 was paid per share during the year

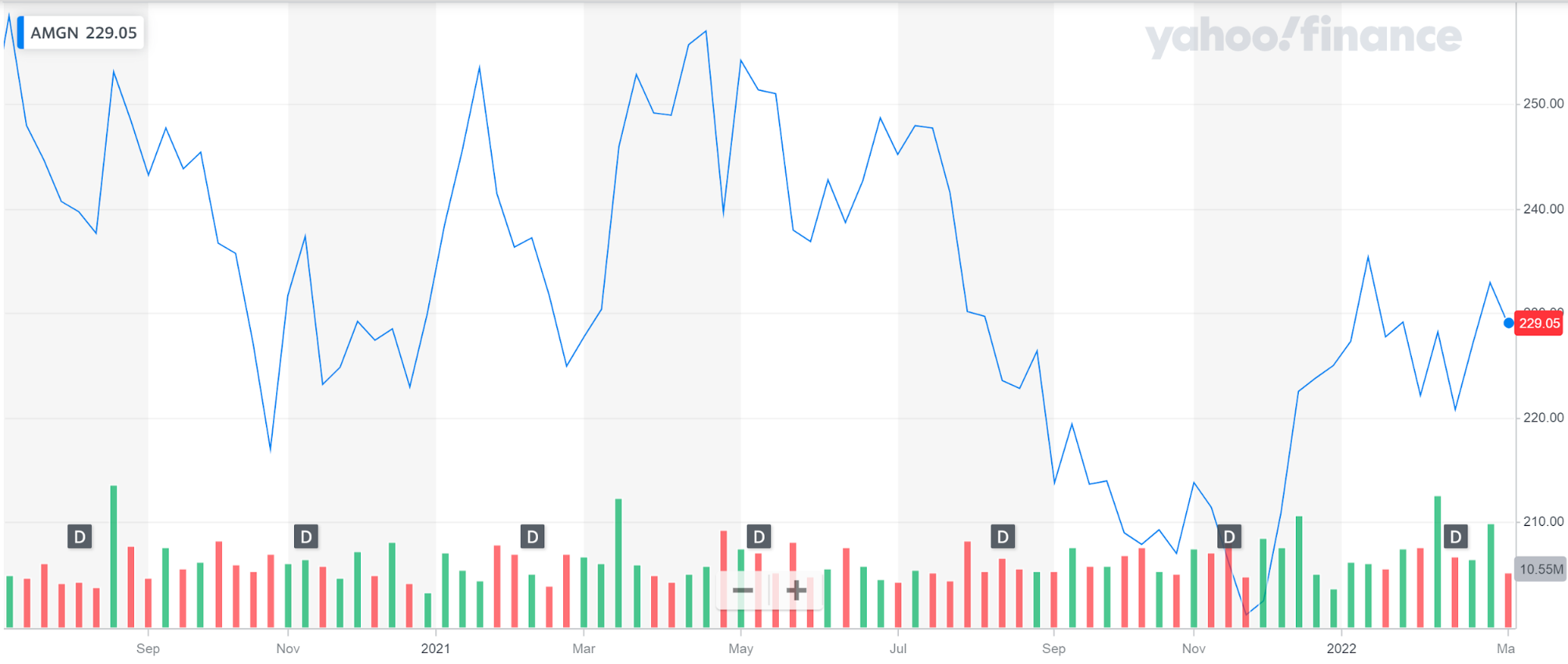

Amgen has a market capitalization of around $127.6 billion. The company’s stock is currently trading at $229. The stock of the company has exhibited high volatility in the past eighteen months. In mid-2021, the stock of the company started declining. After dropping to $201, the stock changed course at the end-November 2021 and started rising again.

EV stocks are one of the plenty of investment opportunities to take advantage.

EV stocks are one of the plenty of investment opportunities to take advantage.

Genmab

Genmab is a biotech company that develops and produces innovative therapies for the treatment of cancer, including antibody-drug conjugates. GMAB’s lead product, DARZALEX® (daratumumab), is a monoclonal antibody that targets CD38. The global pharmaceutical stock market has experienced significant growth in recent years.

Genmab recently announced its full-year results for 2021.

- Total revenue was reported to be DKK 8,482 million (Approx. $1,253 million) in 2021

- Net Profit was reported at DKK 3,008 million (approx.. $456 million)

Genmab has a market valuation of $21.4 billion. Its share is trading at a price of $32.69. Looking at the past eighteen months’ performance of the stock, the stock plunged twice. The recent drop in price occurred when the stock hit $48.72. The stock continues its bearish trend.

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. is a biotechnology company, which engages in the discovery, invention, development, manufacture, and commercialization of medicines.

The highest revenue generator drug of Regeneron is Eylea. It is an eye disease drug that the company makes in collaboration with the company Bayer. Regeneron is also selling autoimmune and cancer drugs under its partnership with the life sciences and pharma company Sanofi.

Regeneron recently published its fourth quarter and full-year results of 2021. The company delivered strong results across its core business with impressive sales of EYLEA and Dupixent. Also, the company kept up its efforts towards the ongoing pandemic by delivering REGEN-COV to millions of patients

- The company reported $16.07 billion in revenues for the year 2021. Revenues increased by 89% during the year.

- Net income for the year 2021 was reported at $8.1 billion. Net income increased by 130% during the year.

Regeneron has over 30 product candidates in clinical development, including a number of marketed products for which it is investigating additional indications. Get to know the list of crypto mining companies that are leading the industry.

Regeneron is a $67 billion company. Its share is trading at a price of $623.4. The share price has had multiple dips and peaks in the past two years. After the huge dip due to COVID-19, the share picked up a growth streak and touched $644 before dropping. The share dipped to $450 and changed its course again. The share is currently on a bullish run.

Vertex Pharmaceuticals

Vertex Pharmaceuticals

Vertex is a global biotechnology company that is popular for its medicines for cystic fibrosis (CF), a rare, life-threatening genetic disease. With its four CF medicines, Vertex is treating around half of the 83,000 patients living with CF in the United States, Europe, Canada, and Australia. The approval of Trikafta’s, a triple combo CF medicine, is the most significant milestone for the company. This drug has the potential to take the company to higher growth levels as it has the potential to treat up to 90% of CF patients. There are multiple paid courses and technical analysis books available which provide in-depth knowledge about Technical Analysis.

Vertex recently published its fourth quarter and full-year results for 2021.

- Product revenues were reported at $7.5 billion, representing a 22% increase. The Trikafta drug proved to be the highest revenue-generating product, contributing 75% of the total revenue.

- Net Income was reported at $2.3 billion, representing a 14% decline. The reason behind the decline was the $900 million payment in reference to the amendment of Vertex’s collaboration with CRISPR Therapeutics. It was considered an R&D expense by the company.

- Net Income per share was recorded at $9.01

Vertex Pharmaceuticals is a $61 billion company. The company’s share is trading at a price of $ 239.24. The company’s share performance has remained steady in the past eighteen months. The share price has remained near $200.

Check our updated for NASDAQ Forecast.

Check our updated for NASDAQ Forecast.

Novavax Inc

Novavax is a clinical-stage vaccine company committed to delivering novel products to prevent a broad range of infectious diseases. The Company, through its recombinant nanoparticle vaccine technology, produces vaccine candidates to respond to both known and newly emerging diseases.

Novavax developed VX-CoV2373. This is the first protein-based COVID-19 vaccine authorized in multiple major markets around the world, including the European Union, Australia, Canada, and Great Britain

Novavax Inc recently announced its fourth-quarter and full-year earnings report.

- The company reported revenue of $1.1billion for the year.

- A total of $2.5 billion was spent on R&D majorly because of the development of the COVID-19 vaccine.

The company reported a net loss of $1.7 billion

- The future outlook is very high with expected revenue to reach $4 to $5 billion.

The company is a $6 billion company. The company’s share is trading at a price of $79.07. the share price peaked at $290 during the first quarter of 2021. Since then the share price of the company has been extremely volatile. The share of Novavax experienced multiple peaks and trenches since then and has been steadily declining.

Also read: Best 5G Stocks to Invest In

Also read: Best 5G Stocks to Invest In

Relay Therapeutics

Relay Therapeutics, Inc. operates as a clinical-stage precision medicines company. It engages in transforming the drug discovery process with an initial focus on enhancing small molecule therapeutic discovery in targeted oncology and genetic disease indications. Currently, Relay Therapeutics is building the world’s first dedicated drug discovery platform centered on protein motion to discover and develop new medicines that will make a transformative difference for patients. By placing protein motion at the heart of drug discovery, Relay is pursuing what it believes will be a fundamental paradigm shift within the pharmaceutical industry.

Relay Therapeutics recently announced its full-year report for the year 2021.

- A total of $173 million were invested in R&D during the year.

- Net loss was reported to be $363.9 million for the year

Relay Therapeutics has a market capitalization of $2.64 billion. Its shares are trading at a price of $24.39. After peaking at $61 during January 2021, the company’s stock has been declining. The company’s stock kicked off in the year 2022 at a price of $30.

The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

Axsome Therapeutics

Axsome Therapeutics, Inc. is a biopharmaceutical company that engages in the development of novel therapies for central nervous system (CNS) disorders.

The company recently announced its fourth-quarter and full-year 2021 results.

- A total of $58.1 million was spent on R&D during the year.

- Net loss was reported to be $130.4 million for the whole year

The company has a market capitalization of over $1.21 billion. Its share is trading at a price of $31.55. the company’s stock has been steadily declining over the past year. The stock took a huge dip in August 2021 and since then the stock has been unstable.

You may also like reading:

You may also like reading:

CONCLUSION

Biotech is a growing sector. One of the key rules of earning a good return, as per Warren Buffett is to invest in sectors that have growth potential. Moreover, with the rising trend of mergers, small-scale biotech companies are merging with big companies to get more funds for the development of their drugs.

On the cutting edge, some biotech stocks are pushing the boundaries of machine learning and artificial intelligence. Their goal is to treat diseases many believed were “undruggable.” This is yet to provide any result. Get to know the best artificial intelligence stocks.

The above-mentioned companies have been selected because of their products in the market and other drugs which are in pipelines. Many companies are investing heavily in R&D to bring new innovative drugs to the public. Their products and their demand in the market. Hence, the above-mentioned companies are our top picks for the best biotech stocks to buy in 2021.

You may also like reading:

- Best Penny Stocks to Invest

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy

- Best Stock Forecasts & Prediction Services & Websites

- Best Drone Stocks to Invest

- Best Forex Trading Platforms

- Best Stock Trading Apps

- Best Day Trading Stocks

- Best Airline Stocks

- Best Forex Signals

- Most Volatile Stocks

- Best Crypto Signals

- Best Undervalued Stocks

- Best Lithium Stocks to Buy in 2024

- Best Robinhood Stocks to Buy in 2024