The dynamics of the car industry are changing with the shift towards electric cars. The EV market size is expected to grow to 245 million vehicles by 2030. With this increase in demand for electric vehicles, there will be a huge increase in demand for lithium because EV cars use lithium-ion battery cells. XPENG is one of the best EV stocks to invest in today. There is no denying the fact that very soon the roads will be populated by all-electric vehicles. Moreover, renewable technology is accelerating in demand, and companies like Tesla are increasing purchasing on lithium which is a key item used in their products.

The dynamics of the car industry are changing with the shift towards electric cars. The EV market size is expected to grow to 245 million vehicles by 2030. With this increase in demand for electric vehicles, there will be a huge increase in demand for lithium because EV cars use lithium-ion battery cells. XPENG is one of the best EV stocks to invest in today. There is no denying the fact that very soon the roads will be populated by all-electric vehicles. Moreover, renewable technology is accelerating in demand, and companies like Tesla are increasing purchasing on lithium which is a key item used in their products.

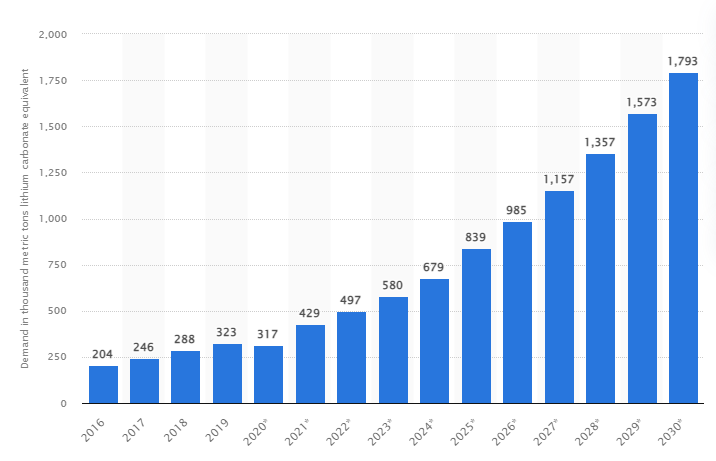

Therefore, the demand for lithium is expected to soar. This indicates a lithium boom and an excellent opportunity to invest in lithium stocks.

The below chart shows the forecasted demand of lithium up till 2030, as per Statista:

List of Best Lithium Stocks to Buy in 2024

List of Best Lithium Stocks to Buy in 2024

| Sr. | Company Name | Symbol | Market Capitalization | Price (As of 29th December 2021) |

| 1 | Ganfeng Lithium co. | GNENF | $ 29.765 billion | $ 15.47 |

| 2 | Albemarle | ALB | $ 27.2 billion | $ 232.53 |

| 3 | Sociedad Química y Minera | SQM | $ 14.63 billion | $ 51.23 |

| 4 | FMC Corporation | FMC | $ 13.867 billion | $ 109.4 |

| 5 | Quantumscape Corporation | QS | $ 9.31 billion | $ 22.03 |

| 6 | Livent Corporation | LTHM | $ 4.014 billion | $ 24.84 |

| 7 | EnerSys | ENS | $ 3.307 billion | $ 78.95 |

| 8 | Lithium Americas | LAC | $ 3.481 billion | $ 28.96 |

| 9 | Energizer Holdings | ENR | $ 2.65 billion | $ 39.84 |

| 10 | Piedmont Lithium Limited | PLL | $ 807 million | $ 50.86 |

Ganfeng Lithium Co.

Ganfeng Lithium Co. is one of the world’s leading Lithium manufacturers, located in China. Our products are widely used in electric vehicles, energy storage, consumer electronics, chemicals, and pharmaceuticals. The pharmaceutical stocks growth rate has accelerated in the past few years. The company exports and produces over 20 unique lithium products. The company’s lithium metal batteries are a huge hit which has been developed a breakthrough technology that reduces the production process. Tech Stock investment has its own set of Pros and Cons which you should consider as an investor before deciding to invest

In the half-yearly report for the year, Ganfeng reported:

- Revenue of RMB4,025,024,000, representing an increase of RMB1,650,418,000, as compared when same period last year

- Operating income of RMB4,025,024 thousand, representing an increase of 69.50% as compared with the same period last year

- Profits attributable to the owners of the parent company of RMB1,415,176 thousand, representing an increase of 797.41% as compared to the same period last year

Ganfeng Lithium has a market capitalization of $ 29.77 billion. Its share is trading at a price of $15.47. The share of Ganfeng, as shown in the chart below, is on a bullish run since the last quarter of 2021. The stock kicked off the year 2021 at $ 11.82. During the year it peaked at $ 21.7 in August and is now trading at roughly 30% less price when compared to the peak price.

Ganfeng plans to continuously expand its current lithium resources portfolio through further exploration, with a gradual focus on extraction development of brine, lithium clay, and other resources. This will support the increased demand and sustains the company’s growth.

Ganfeng plans to continuously expand its current lithium resources portfolio through further exploration, with a gradual focus on extraction development of brine, lithium clay, and other resources. This will support the increased demand and sustains the company’s growth.

Alo read the best robinhood stocks.

Albemarle

Albemarle is a global specialty company and a leading global producer of Lithium, Bromine, and Catalyst solutions. It powers the potential of companies in many of the world’s largest and most critical industries, such as energy, electronics, and transportation.

In its recent quarterly report, the company reported:

- Net sales of $830.6 million, an increase of 11% year-on-year

- Net loss of ($392.8) million

- Announced agreements for strategic investments in China with plans to build two lithium hydroxide conversion plants, each initially targeting 50,000 mtpa

Albemarle has a market capitalization of around $27.2 billion. Its share is trading at $232.53. the stock of the company, as shown in the chart below, is on an upward streak since last year. The share kicked off in the year 2021 with a price of $ 147.53. During the year it peaked at $281.43 during November-2021. From the start of the year, till date, the share has appreciated by roughly 60%.

Albemarle is hugely benefiting from higher volumes in its lithium business due to the return of the global economic situation back to normalcy. Also, the high lithium prices are further driving its performance upwards. The company is strategically executing its projects aimed at boosting its global lithium derivative capacity. Also, the company is focused on investing in high-return projects to drive productivity. Undoubtedly, the company is well-positioned to benefit from the upsurge in the battery-grade lithium demand.

Albemarle is hugely benefiting from higher volumes in its lithium business due to the return of the global economic situation back to normalcy. Also, the high lithium prices are further driving its performance upwards. The company is strategically executing its projects aimed at boosting its global lithium derivative capacity. Also, the company is focused on investing in high-return projects to drive productivity. Undoubtedly, the company is well-positioned to benefit from the upsurge in the battery-grade lithium demand.

Also check out our list of best cryptocurrencies.

Sociedad Química y Minera

Sociedad Química y Minera is a global company that holds the leading position in the lithium, potassium nitrate, iodine, and thermo-solar salts markets. Solar energy stocks have led this quarter’s stock market gains.

In its recent quarterly report, the company reported:

- Revenue of $ 662 million, representing a 46% increase from the same period last year

- Lithium revenue comprising of a total of 30% of total revenue. The sale of lithium almost doubled in a year-on-year comparison

- Net income of $ 106 million

In the year 2021, the total CAPEX was $ 500 million. From 2021-2024 the company plans a CAPEX of $ 2 billion which will be focused on:

- Lithium Capacity Expansion – $ 1.1 billion

- Nitrate and Iodine Expansion – $ 440 million

- Annual Maintenance – $ 120 million

Sociedad Química y Minera has a market capitalization of around $14.6 billion. Its share is currently trading at $ 51.23. The share of Sociedad Química y Minera, as shown in the chart below, is on an upward journey since last year. During 2020, the share was on a bullish run after the March-2020 market crash. During the year 2021, the share price journey was marked by volatility with multiple dips and rises throughout the year. The share kicked off in the year 2021 at a price of $ 40. It peaked at $ 66 in November and is currently at a price that is 22% less than the peak price. Robinhood stocks offers some of the lowest cost trading in the industry.

Get to know everything about high frequency trading.

FMC Corporation

FMC Corporation is a major worldwide producer of chemicals and machinery for industry, government, and agriculture. The company’s business is divided into five major segments: Performance Chemicals, Industrial Chemical, Machinery and Equipment, and Defense Systems & Precious Metals. FMC Corporation ranks as an industry leader in the production of lithium-based products. The FMC Lithium Division is committed to providing complete solutions to major identifiable markets, including air treatment, construction, energy, fine chemicals, glass and ceramics, greases and lubricants, polymers, and others. Best energy stocks are those that can survive a downward shift in the economy.

In its recent financial report, the company reported:

- Revenue of $ 1,194 million, a 10% increase on a year-on-year basis

- Net income of $ 160 million, a 43% increase on a year-on-year basis

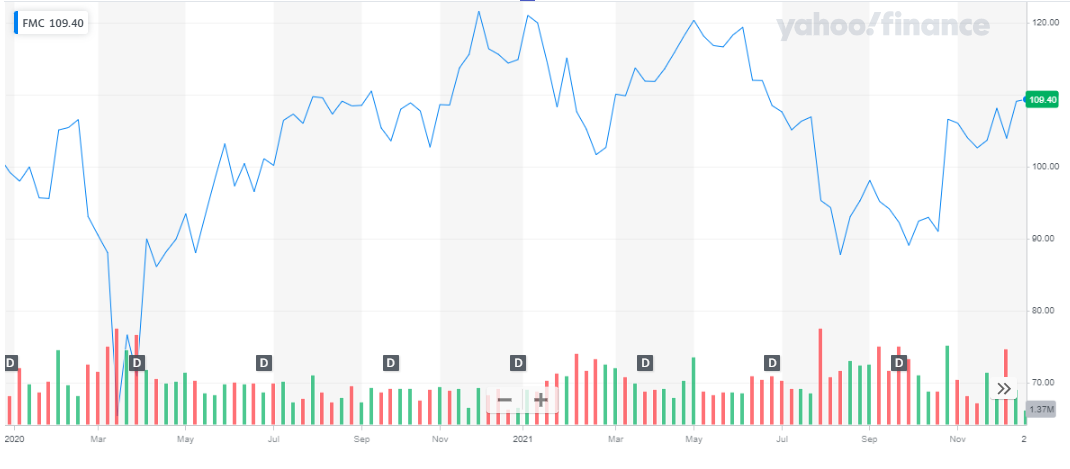

FMC Corporation has a market valuation of $13.9 billion. Its share is trading at $ 109.4. the share price appreciated hugely during 2020 after the huge dip during the March-2020 crash. The share price journey, as shown in the chart below, has been pretty volatile during the current year. The share kicked off the year 2021 at a price of $ 114.9 and is currently trading at a 5% lesser price as compared to the year’s start price.

Read more:

QuantumScape Corporation

QuantumScape is a leader in the development of next-generation solid-state lithium-metal batteries for use in electric vehicles. What sets QuantumScape aside amongst the EV battery manufacturers is that it specializes in solid-state lithium metal batteries which have no liquid in them. Having no liquid reduces the risks while using as there are no dangers of leakage. Also, solid-state batteries offer a higher range and extremely fast charging time. And not to forget that this technology is far more cost-effective. The company has also been backed by Bill Gates and Volkswagen

QuantumScape Corporation has a market valuation of $ 9.3 billion. Its share is currently trading at $22.03. The company went public on Nov. 27, 2020. QuantumScape completed its business combination with Kensington Capital Acquisition Corp, a special purpose acquisition company in the last quarter of 2020. The company’s share, as shown in the chart below, skyrocketed during the last two months of the year 2020. The reason behind the sharp increase was mere speculation as per investors. Get to know the best quantum computing stocks.

Livent Corporation

Livent Corporation

Livent is a lithium compound producer that specializes in lithium extraction and purification technology. Its primary products, namely battery-grade lithium hydroxide, lithium carbonate, butyllithium, and lithium metal are critical inputs used in various performance applications. The company has been powering the world through lithium for nearly eight decades.

In its recent quarterly report, the company reported:

- Revenue of $ 102 million, a 43% increase on a year-on-year basis

- Net loss was reported at $ 12.6 million

- It remains on track to deliver its near-term capacity expansions, with the 5,000 metric ton hydroxide addition in Bessemer City and initial lithium carbonate expansion of 10,000 metric tons in Argentina expected to reach commercial production by the third quarter of 2022 and the first quarter of 2023, respectively

Livent Corporation has a market valuation of $ 4.1 billion. Its share is trading at $ 24.84. The stock of the company is on a bullish run since last year, as shown in the graph below. The stock price kicked off the year 2021 at a price of $ 18.54 and has appreciated by 22% to date. The share peaked at $ 31.3 during November 2021.

Also read:

Also read:

EnerSys

EnerSys is the global leader in stored energy solutions for industrial applications. It is the largest industrial battery manufacturer in the world, operating manufacturing and assembly facilities worldwide for customers in over 100 countries.

In its recent quarterly report, the company reported:

- Net sales of $791.4 million, representing a 12% increase on a year-on-year basis

- Net earnings were reported at $35.7 million

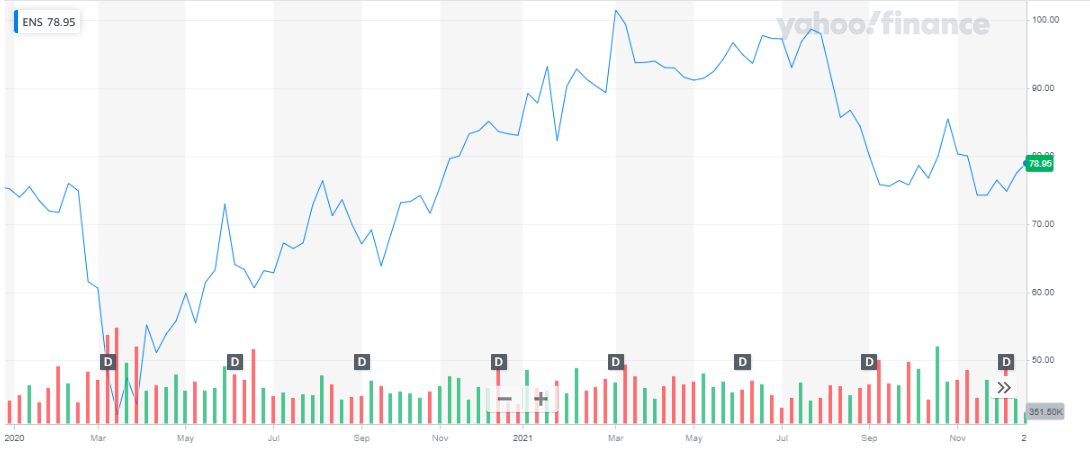

Enersys has a market valuation of around $ 3.3 billion. Its share is trading at $78.95. The stock of the company, while exhibiting volatility, has appreciated since the March-2020 market crash till the first half of 2021. The share of the company continued to increase in 2020. The share kicked off the year 2021 at a price of $ 83.06. It is currently trading at a price which is 5% lower as compared to the start of the year. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

Lithium Americas

Lithium Americas

Lithium Americas is a development-stage company focused on advancing to the production of a lithium brine operation in Jujuy, Argentina, and a sedimentary lithium clay project in Nevada, United States.

In its recent quarterly report, the company reported:

- Net Loss of $17.2 billion

Lithium Americas has a market capitalization of $ 3.48 billion. Its share is trading at $ 28.96. the share has been on an upward journey since last year. But the stock picked up pace in 2021. The share kicked off at a price of $ 12.55 at the start of the year. It peaked at $ 37.49 during November-2021. The share price has grown by 130% since the start of the year. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Energizer Holdings

Energizer Holdings

Energizer Holdings manufacturers, marketers, and distributors household and specialty batteries, portable lights, and auto care products. It offers lithium, alkaline, carbon-zinc, nickel-metal hydride, zinc-air, and silver oxide batteries under the Energizer and Eveready brands. Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2023.

In its recent quarterly report, the company reported:

- Net Sales of $ 766 million

Energizer Holdings has a market capitalization of $ 2.65 billion. Its share is trading at a price of $ 39.84. The share of the company, as shown in the graph below, has exhibited extreme volatility in the past two years. The share kicked off the year 2021 at a price of $ 42.18. The stock price has declined by 5.5% from the start of the year to date. There has been a lot of focus on the long-term investment approach. Also, long-term stocks have been beneficial for traders around the world.

Piedmont Lithium Limited

Piedmont Lithium Limited

Piedmont Lithium is an emerging lithium company focused on the development of its 100%-owned Piedmont Lithium Project in North Carolina, intending to become a strategic domestic supplier of lithium to the increasing electric vehicle and battery storage markets in the U.S.

The company lacks established reserves; therefore, a steady stream of revenues is unpredictable and uncertain. The company has not realized any revenue from the sale of lithium. The company recently ported its 2021 annual report. Net loss was reported to be $ 19.9 million

Piedmont Lithium Limited has a market capitalization of $ 807 million. Its share is currently trading at a price of $ 50.86. The share of the company, as shown in the below chart, has had an amazing 2021. From a price of $ 26.55, at the start of the year, the share has almost doubled to date. There is a vast array of trading courses available online which you can join, each with its own merits and every course suitable for different types of traders.

CONCLUSION

CONCLUSION

The rising demand for rechargeable batteries and supply disruptions has escalated lithium prices. Moreover, the increased production and demand for EVs is leading towards the growth in the lithium segment. The above-mentioned companies have been portraying excellent growth prospects and are hugely benefitting from the growth in EVs and increased demand for rechargeable batteries. Therefore, these are the best Lithium stocks to buy in 2023 to benefit from a growing sector.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

- Best Oil Stocks to Buy in 2023

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Swing Trading Stocks to Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy