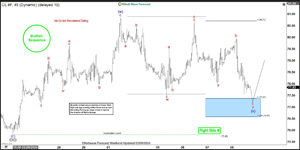

Nikkei (NKD) Has Reached Support Zone

Short term Elliott Wave view in Nikkei Futures (NKD) suggests that rally to 40960 ended wave 3. Pullback in wave 4 is currently in progress as a double three Elliott Wave structure. Down from wave 3, wave (a) ended at 40025 and wave (b) ended at 40805. Wave (c) lower ended at 39285 and this completed wave ((w)) in higher degree. The Index then bounced in wave ((x)) which ended at 40324 as the 1 hour chart below shows.

The Index ... Click here for more detail