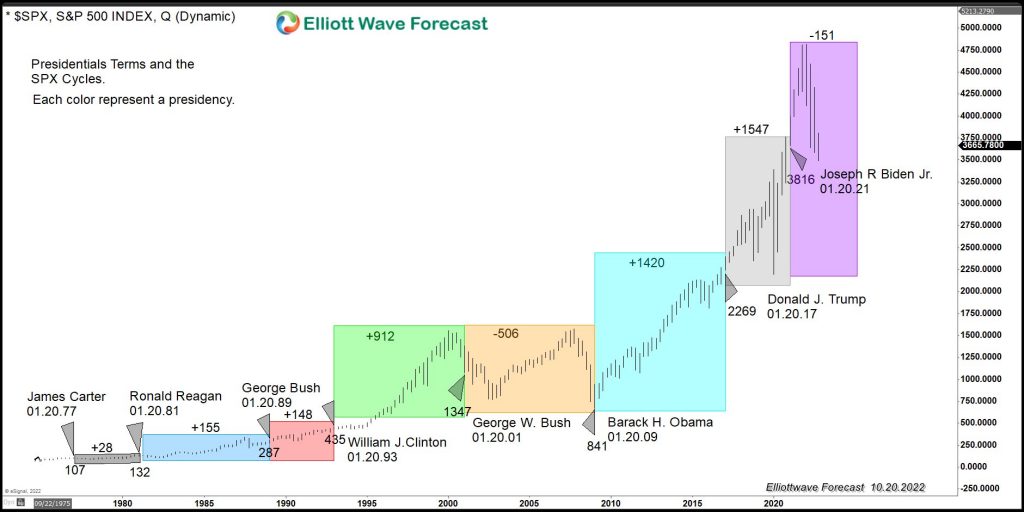

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

Elliott Wave Calling for FTSE to Extend Higher

Read MoreFTSE Has Ended Correction and Extended Higher. This article and video look at the Elliott Wave path of the Index in shorter cycle.

-

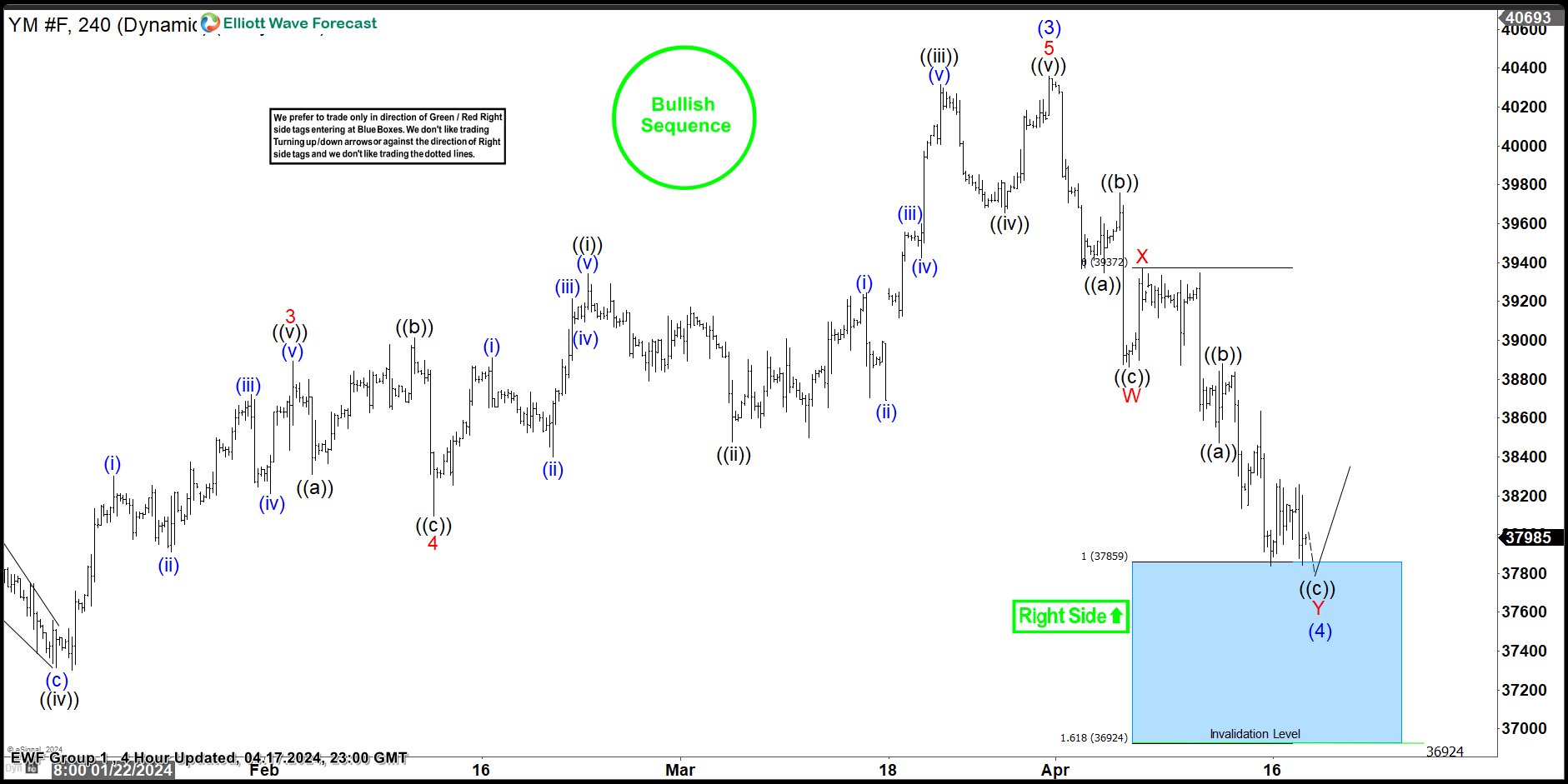

$YM_F Dow Futures Reacting Higher After Double Correction Lower

Read MoreThis technical blog will look at the past performance of the 4-hour Elliott Wave Charts of Dow futures ticker symbol: $YM_F. We presented to members at the elliottwave-forecast. The rally from the 03 October 2022 low unfolded as an impulse structure and showed a bullish sequence. The index should see more upside extension to complete the impulse sequence. […]

-

American Airlines (AAL) : Buying The Stock at the Blue Box

Read MoreHello fellow traders, As our members know we have had many profitable trading setups recently. In this technical article, we are going to present another Elliott Wave trading setup we got in American Airlines (AAL) . The stock completed correction precisely at the Equal Legs zone, referred to as the Blue Box Area. In the […]

-

Platinum (PL) Turning Higher

Read MorePlatinum (PL) looks to have formed a bottom and the metal has started to rally higher in the next bullish cycle. The metal still needs to break above 1348.2 to confirm that the next leg higher has started. Below we updated the Monthly and Daily Elliott Wave chart for the metal. Platinum (PL) Monthly Elliott […]