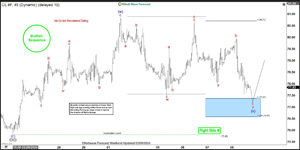

Elliott Wave Theory Suggests EURJPY Remains Bullish

Short term Elliott Wave view in EURJPY suggests that rally to 165.35 ended wave 3. Wave 4 pullback unfolded as a double three Elliott Wave structure. Down from wave 3, wave ((w)) ended at 162.59 and wave ((x)) ended at 165.17. Down from there, wave (w) ended at 163.85 and wave (x) ended at 164.69. Wave (y) lower ended at 162.26 which completed wave ((y)) of 4 in higher degree. Pair has turned higher in wave 5.

Up from wave 4, wa... Click here for more detail