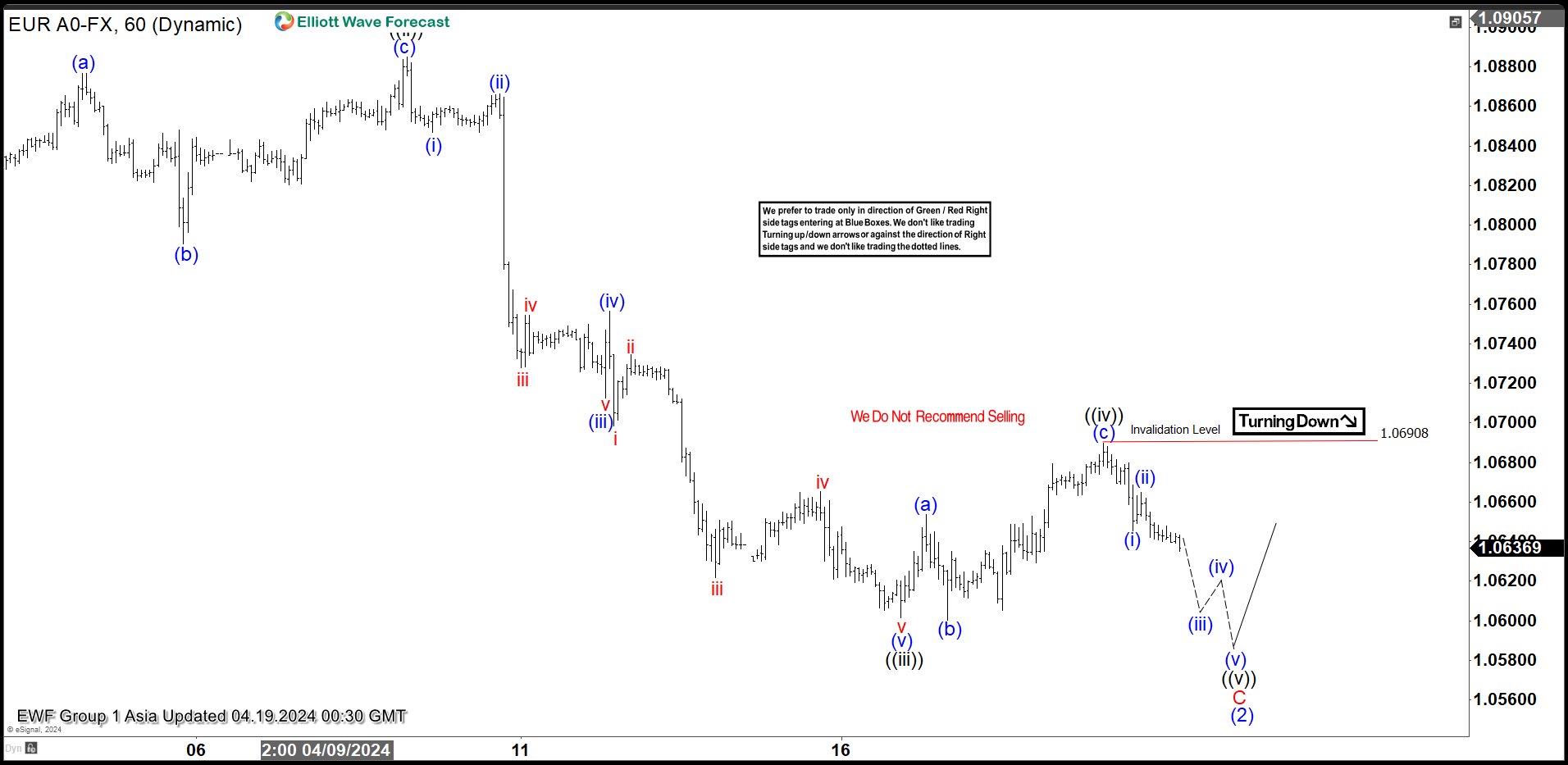

Forecast with Elliott Wave Technique Calling EURUSD to Extend Lower

Short term Elliott Wave view in EURUSD suggests that cycle from 12.28.2023 high is in progress as a zigzag Elliott Wave structure. Down from 12.28.2023 high, wave A ended at 1.0694 and rally in wave B ended at 1.098. Wave C lower is in progress as a 5 waves impulse Elliott Wave structure. Down from wave B, wave ((i)) ended at 1.072 and rally in wave ((ii)) ended at 1.0885. Pair extends lower in wave ((iii)) with internal subdivision as an...

Click here for more detail